The answer to this question really depends on a five main factors: your age, income, family size, location, and the type of plan you choose. That’s because the Patient Protection and Affordable Care Act provides subsidies for middle-income individuals, families, and small businesses. It also expands free Medicaid for low-income households. It taxes higher-income families, businesses that don’t provide health benefits, and people who don’t sign up for insurance unless they are exempt.

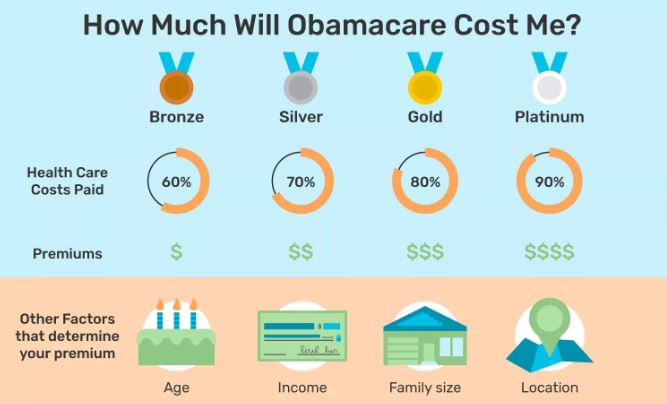

First, your cost depends on the plan category you choose. All health insurance plans fall into one of four categories. They all offer the same 10 essential health benefits. The four categories are:

- Bronze – Has the lowest premiums, but only pays 60 percent of your health care costs. Pick this plan if you don’t expect a lot of medical bills.

- Silver – Pays 70 percent of your covered medical costs, but the premiums are higher than the Bronze plan.

- Gold – Pays 80 percent of your costs, with higher premiums than the Silver plan.

- Platinum – Pays 90 percent of your costs, but has the highest monthly premiums. It will make sense to pick this plan if you have a chronic health condition.

The plans in each category allow you to compare monthly premiums, deductibles, copays, and annual out-of-pocket maximums. That’s where it gets tricky. Even within the same category, the plan with the lowest premium may have the highest deductible. Having a higher deductible means that you might end up paying more for health costs if you get sick than you would with a plan with a higher premium but lower deductible. So you’ve got to estimate how much actual health care costs will be, then determine the insurance plan that helps you cut the total cost the most.

Second, your costs depend on your age. Health insurance companies are allowed to charge higher premiums for older people. But they can’t charge more than three times the premium for younger people.

Third, is where you live. That’s because the cost of living, including healthcare, is higher in some cities than in others. However, this is broken down by county, so within the same county there will not be a difference in premiums based upon location.

Fourth and fifth are your income and family size. If you make 400 percent or less of the federal poverty level, you will receive a subsidy. Here’s how the subsidy works. Say you are a single person and you earn $47,520 (roughly 400 percent of the poverty level). Obamacare promises you won’t pay more than 9.5 percent of your income a year, or $4,514, for the second-lowest Silver plan. Your subsidy is the cost of the plan, minus $4,514. So if the plan is $5,000, your subsidy is $485. What if you want a more expensive plan? Obamacare bases all subsidies on the cost of the second-lowest Silver plan. So your subsidy is still $485 a year, which you can apply to any plan. You pay the difference. Sound confusing? Our licensed agents can calculate your subsidy and run you a quote in a few short minutes! Give us a call 813-563-5577

How Much Will Obamacare Cost Me If:

I Make Less Than $16,753 (or $34,638 for a Family of Four) – If your income is 138 percent or less of the federal poverty level, you qualify for expanded Medicaid. That means Obamacare costs you zero. But many states, including Florida, did not expand Medicaid. If you fall within this income range, and you can’t get Medicaid from your state, here’s what happens. First, you won’t have to pay the tax for not having insurance. Second, if your income is so low that you don’t pay taxes, you’re exempt from the tax. Third, you can still apply for insurance on the exchange.

I Make Less Than $30,350 ($62,750 for a Family of Four) – If your income is under 250 percent of the poverty level, you pay no more than 8.05 percent of income for the Silver Plan. In other words, your subsidy is the cost of the second lowest Silver Plan minus 8.05 percent of your income. Use Healthcare.gov’s subsidy calculator to find out how much.

I Make Less Than $48,560 ($100,400 for a Family of Four) – If your income is under 400 percent of the poverty level, you pay no more than 9.5 percent of income for the Silver Plan. In other words, your subsidy is the cost of the second lowest Silver Plan minus 9.5 percent of your income.

I’m Not Planning to or Didn’t, Get Insurance – If you are without insurance for three months or more, you’ll owe an extra income tax of 2.5 percent of your adjusted gross income when you pay your 2018 income taxes. It can’t be less than a minimum flat penalty of $695 per adult plus $347.50 per child, up to $2,085 per household. It can’t be more than the cost of the Bronze plan. But the Trump administration directed the Internal Revenue Service to ignore this requirement and not assess the tax. The Tax Cut and Jobs Act repealed this tax effective 2019.

Even though you don’t have to pay the tax, it’s still a good idea to at least have catastrophic insurance. For example, the average emergency room visit is $1,265. If you break your foot, treatment could cost $16,000. Cancer treatment can cost $30,000, with $7,000 going for chemotherapy alone. Star Nsurance offers plans to cover events like this, and these plans are inexpensive and can often be bundled with your Obamacare plan to get you a great plan at a low price.

I Have Insurance – Your health insurance costs stay the same. But, you might get a better plan for lower costs from Obamacare. Keep in mind, too, that health insurance costs are rising regardless of Obamacare. Businesses have been putting more of the cost onto employees for years, just to keep their profit margins. Health care costs have been rising, on average, 3-4 percent a year, so insurance companies are raising their fees to cover their profit margins. So if your health insurance costs have been rising, they will continue to do so for these reasons.

Catastrophic insurance is considered qualified insurance. But you may want to compare it to a full-coverage plan on the exchange to see if you can lower your overall health care costs. Remember that if you do switch, you won’t be able to go back unless you are under 30 or have some other circumstances.

The ACA improves Medicare costs. It reduced Part D costs if you fall into the “doughnut hole” gap in prescription drug coverage. By 2020, the doughnut hole will disappear. Medicare is not the purpose of this article, but you can read more on Medicare HERE

Similarly, if you have insurance coverage under a retiree plan, CHIP, TRICARE, and other veterans’ health care programs, or the Peace Corps Volunteer plan, your costs don’t change. If you have COBRA, you can keep it. But you will probably get a better deal on the exchanges.

I Make More than $200,000 ($250,000 for Married Couples) – Those making more than $200,000 a year ($250,000 for married couples filing jointly, $125,000 for married couples filing separately) pay these additional investment taxes:

- An additional 0.9 percent Medicare hospital tax on the income above the threshold.

- An extra 3.8 percent on the lesser of (a) investment income like dividends and capital gains or (b) adjusted gross income that is above the threshold.

- This tax applies if you sell your home and you make more than $250,000 (singles) or $500,000 (married couples) in capital gains. If you’re selling investment property, you don’t receive this exclusion. It all counts as capital gains.

I Deduct Medical Expenses – If you deduct your medical expenses that aren’t covered by your health insurance, Obamacare initially cost you more. Until 2017, you could only deduct costs that exceeded 10 percent of your income. The Tax Cut and Jobs Act restored that level to 7.5 percent of income for tax years 2017 and 2018. In 2019, the level returns to 10 percent.

I Use a Flexible Health Savings Account – You can only save $2,500 pre-tax. Over-the-counter drugs are no longer eligible FSA medical expenses. If you don’t use FSA funds for medical expenses, the tax penalty increase to 20 percent. If you are going to use your FSA, we definitely recommend using it only for qualified Medical expenses. Tax Questions – call Tampa Bay Taxes at 813-515-0323

I’m a Small Business Owner – If you have 25 employees or less, you receive a tax credit of 35 percent of the insurance you provide.

Those with 50 employees or less can use the exchange to find lower-cost insurance.

Those with 50 or more employees must provide affordable health insurance that provides minimum value or pay a tax of $2,000 per employee, for all but the first 30 employees. If a worker finds a lower-cost plan on the exchange, you may be taxed. That started in January 2015.

Businesses offering health insurance to early retirees ages 55-64 can get federal financial assistance. Here are more resources to help small businesses comply with Obamacare.

How we can Help!

Star Nsurance has helped hundreds of people in the Tampa, FL area to get a cheap Health Insurance policy through Obamacare that fits their needs. Since every person’s healthcare needs are different, we take the time to sit with every client to make sure they are getting the correct policy. Being able to write through different carriers gives you the piece of mind that we are finding the best Health Insurance policy at the cheapest price. Call us today for a FREE Health Insurance quote 813-563-5577